Business owners that do not carry workers' comp, when it is required by law, often face stiff fines and penalties by the state. They may also be held liable for replacing employees' lost wages and paying medical expenses for workplace injuries.Failing to provide workers' compensation is a criminal offense in most states. Fines range from $1,000 to over $100,000 depending on the state and circumstances. An owner may also serve up to 7 years in jail for failure to comply with state laws.

When an employee gets injured on the job, workers' compensation insurance provides what's known legally as an exclusive remedy. A business that has coverage under an active policy will not be held liable for job-related injuries except under narrow legal circumstances whereas the employer intended to cause injury to the employee or they were willfully negligent.

The cost of property insurance will be different for every business. The reason for this is because every business has different types and amounts of property it may need to insure. Each type of business has different risk exposures depending on the industry of the business as well.

Some workers' compensation claims may be denied if an investigation indicates an injury or illness is caused by an incident that is not covered. Some injuries that are typically not covered by workers' compensation include:

Every state has workers' compensation laws to protect workers in every industry and career field. Getting hurt on the job happens more than most would think, and there are times when an employee who gets injured while on their worksite can sue for compensation benefits. This can be a challenging law field to fully understand, but The Workers Comp King makes the hardship easier for you by getting you what you are owed.

The government health and safety organizations require businesses to abide by strict worker health and safety mandates in order to remain in compliance with their business license qualifications. Failure to do so can result in that business being shut down and their license to operate taken away until such a time as the health and safety agents deem that the company is once again safe to open for business.

For some businesses, such as an office or retail store, workers comp insurance is one of the least expensive lines of coverage. Other businesses, such as contractors and truckers, will pay more for coverage.The cost of workers comp is based on risk and payroll. As either increases, so does the premium. Workers exposed to more demanding work are more likely to get injured. As payroll increases, so does the number of employees and the likelihood of a claim.

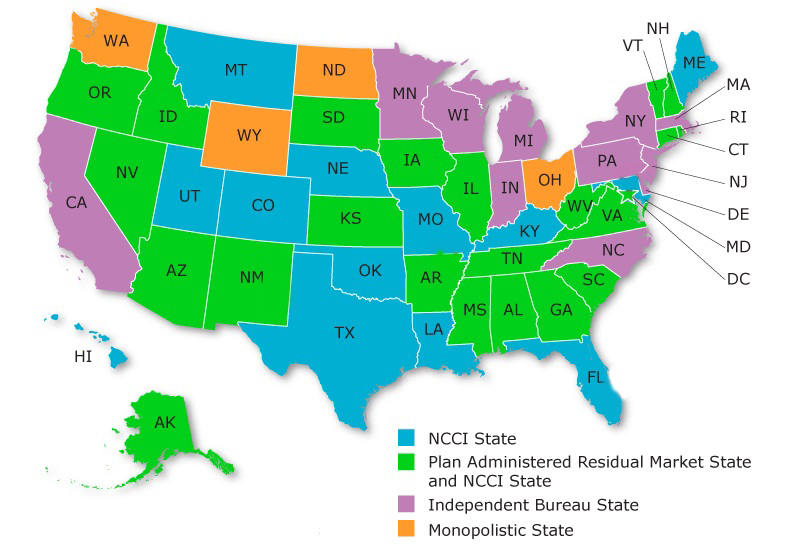

Workers comp pricing is based on several factors. The lowest and the highest rates a workers comp insurance company can charge is filed set and reviewed by each states' insurance regulators. Insurance companies must file their own rates for approval each year. These rates must be within the minimum and maximum range permitted.

Insurance companies utilize the following in order to determine the estimated cost of workers comp:

Covered State

Business Industry and Class Codes.

Annual Payroll

Business Charecteristics.

Claims History

Experience Modification Rate

Credits and Debits history

Our expert staff help large and small business owners with the administration of workers comp. Let us show you how much we can save you on your next quote.We help with employee classification, owner exemptions, payroll rules and more.

With us, you have access to top notch carriers and competitive pricing. We do...

We provide various coverage options which may be available to best protect ...

What good is insurance if you have to haggle over claims if something happens...

We provide various coverage options which may be available to best protect ...

As an employer, workers’ comp benefits you in three key ways. Ensures that your business comply with the law, as having workers’ comp coverage is a law in most states. It protects your business against being sued by an employee in relation to a workplace injury. Also it safeguards your employees against medical costs and lost wages if they become injured or get sick while on the job. Nearly every industry can benefit from workers’ comp coverage. Although some may need the benefits more than others, there’s no replacement for comprehensive workers’ comp coverage if you own a business. That’s because without it, your business could face devastating financial impacts if you or an employee is injured while working. The workers’ comp process is different depending on where your business is located. When it comes to each state, the legal requirements and deadlines to file for coverage vary for each.

When a workers’ compensation claim is filed, employees are protected against paying for certain costs related to the employee’s injuries. These costs include medical care, lost wages, and more. In addition, employers are protected from liability suits regarding the incident. However, there are some direct and indirect costs that employers may face if their employees file workers’ comp claims. For example, an employer may be directly affected in the form of higher insurance premiums. This is because insurers use a business’s workers’ comp claim history to determine insurance premium amounts. In terms of indirect costs, OSHA outlines many indirect expenses related to workplace injuries and workers’ comp claims. Although the laws vary from state to state, most businesses are legally required to have workers’ comp coverage. This coverage not only helps them stay within legal regulations but also helps provide much-needed financial protection when an employee is injured or sick while on the job. Even business owners who aren’t legally required to have coverage can experience many benefits of workers’ comp.

Get the best quotes for the high hazard industries and toughest NCCI class codes. A curated coverage that handles froms claims to audits

Copyright © 2022 Laurence Taylor. All Rights Reserved.